What you need to know:

Sweden’s journey toward a cashless future has been powered by Swish, the go-to solution for instant, secure mobile payments. With over 1 billion transactions in 2023, Swish has transformed how people and businesses handle money – speeding up payments, reducing costs, and enhancing convenience.

💡 With account-to-account (A2A) payments on the rise, Zimpler is making Swish even more accessible and scalable.

Sweden is rapidly embracing instant, cashless payments, fundamentally changing how transactions are conducted.

The Swedish payments market has undergone revolutionary digitalization, with cash and manual services being replaced by cards, mobile phones, and internet solutions. A significant contributor to this transformation is Swish, a mobile payment system that enables real-time money transfers.

In 2023, Swish facilitated 1 billion payments, marking a significant increase from previous years. Its convenience and efficiency have made it a preferred payment method, contributing to the decline in cash usage. This shift towards digital payments has positioned Sweden as a leader in the move towards a cashless society, with Swish playing a pivotal role in this financial revolution.

From simple transfers to business must-have: The evolution of Swish.

It all began… with a connection. A simple yet brilliant idea: what if sending money was as easy as sending a text? What if a phone number could be the key to instant payments?

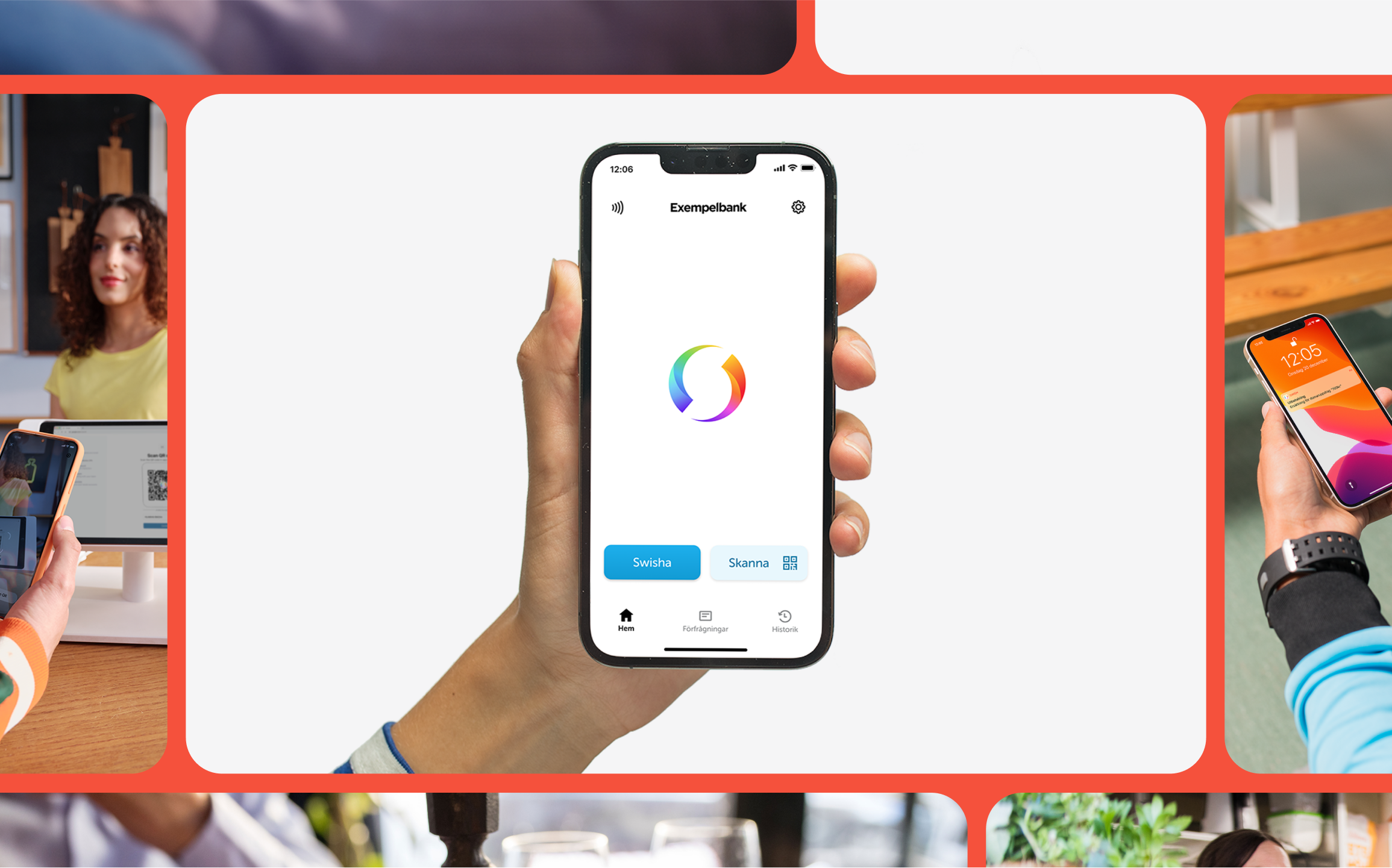

Swish began in 2012 as a collaboration among six major Swedish banks, aiming to provide a simple, real-time money transfer solution for individuals. Users link their mobile numbers to their bank accounts via the Swish app, enabling instant transfers. This innovation has seen widespread adoption, with over 8 million users, covering a substantial portion of Sweden’s 10.49 million population.

Swish’s impact extends beyond peer-to-peer transactions and has become integral to e-commerce and business payments. Its functionality expanded to include payments to small businesses, charities, and even flea market vendors, areas traditionally dominated by cash transactions.

By 2014, organizations could register to receive payments, and in 2017, Swish introduced services for web-based sales, further broadening its application.

A cornerstone of Swish’s success is its integration with BankID. Each transaction is authenticated using BankID, Sweden’s electronic identification system, ensuring both speed and security. Launched in 2003, BankID serves as a secure electronic identification system, allowing users to verify their identities for online services, including banking and government portals.

When making a Swish payment, users authenticate each transaction through the BankID app, ensuring fast and secure transfers. The seamless integration of Swish and BankID has transformed Sweden’s payment landscape, enabling instant payments instead of the delays seen with traditional bank transfers.

Instant payments: The key to Sweden’s digital-first economy.

Instant payments are revolutionizing Sweden’s payments landscape, offering numerous advantages to both consumers and businesses.

Benefits of instant payments:

- Enhanced cash flow: For businesses, the immediate availability of funds improves cash flow management, enabling real-time financial oversight. This immediacy allows companies to optimize working capital and make prompt business decisions.

- Reduced transaction costs: Instant payments often bypass traditional intermediaries, leading to lower transaction fees. This reduction in costs is particularly beneficial for small and medium-sized enterprises, enhancing their competitiveness.

- Improved customer experience: Consumers benefit from the convenience and speed of instant payments, leading to higher satisfaction and loyalty. The ability to transfer funds instantaneously aligns with the expectations of a digitally savvy population.

Swedish consumers and businesses are at the forefront of adopting digital payment solutions, driving the evolution of the country’s payment ecosystem.

- Consumer adoption: The widespread use of mobile payment apps like Swish, which processed over 10 transactions per customer per month in 2023, highlights the shift towards digital wallets and contactless payments.

- Business integration: Companies are increasingly integrating instant payment systems to meet consumer demand for quick and secure transactions. This integration not only enhances customer satisfaction but also streamlines operational efficiency.

As Sweden leads the way as one of the world’s most digital societies, the shift toward a fully cashless future is well underway. At the forefront of this revolution is Swish and A2A payments, seamlessly bridging consumers and businesses with instant, secure payments. Its widespread adoption reflects Sweden’s commitment to efficiency, convenience, and innovation in financial transactions, setting a global benchmark for the digital economy.

How Zimpler enhances Swish and simplifies business transactions.

Swish has become a cornerstone of Sweden’s digital economy, but businesses—especially those in regulated industries—often face challenges with onboarding, compliance, and operational complexity. Zimpler, a leading PSP specializing in instant bank payments, enhances Swish by providing a seamless, scalable solution tailored for business needs.

- Expanding Swish’s business potential – While Swish is ideal for everyday transactions, businesses dealing with regulated markets or requiring a more structured setup benefit from Zimpler’s streamlined onboarding and operational support.

- Seamless integration & compliance – Zimpler provides businesses with a secure, fully compliant payment setup, handling AML and KYC requirements seamlessly. This allows businesses to access Swish payments while ensuring regulatory adherence—without unnecessary complexity.

- Reliable and scalable payment processing – Zimpler connects businesses directly to Sweden’s payment ecosystem, ensuring stable, uninterrupted payment flows with fewer intermediaries.

By combining Swish’s trusted payment method with Zimpler’s advanced business solutions, companies can reduce friction, cut costs, and improve cash flow—all while providing customers with a payment experience they already trust.

Join the payment revolution with Zimpler and Swish.

The information contained in this post is intended for informational purposes only, and should not be relied upon for professional advice of any kind. Zimpler does not make any representation or warranty as to the completeness or accuracy of the information, and assumes no liability or responsibility that may result from reliance on such information.