Zimpler at a glance.

You reach

bank accounts through us.

We process

in yearly volume.

You access

markets with us.

We have

connected banks.

Our name is our promise.

Zimpler is the fastest-growing Pay by Bank network in the Nordics, with a mission to democratize payments and enable growth for businesses worldwide.

Our solutions.

Our innovative platform lets you make and accept payments. But it also helps your business scalability. How? Easy. Choose your own tailored solutions that suit your needs today, and let it evolve as your business grows.

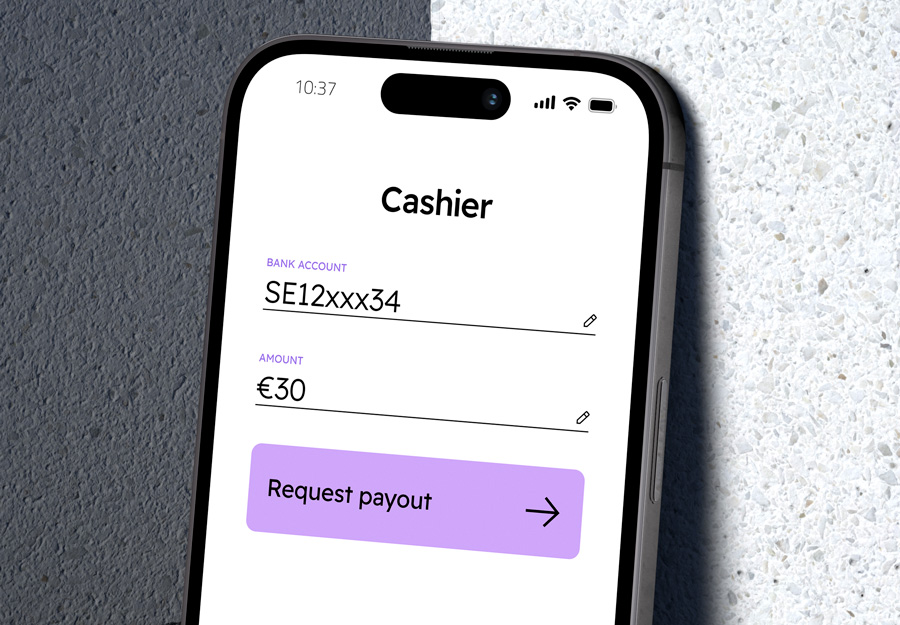

Payouts

Instant or just really fast? A whole lot or just a little? Locally or across borders? You decide how you want to pay your customers. It’s all equally seamless.

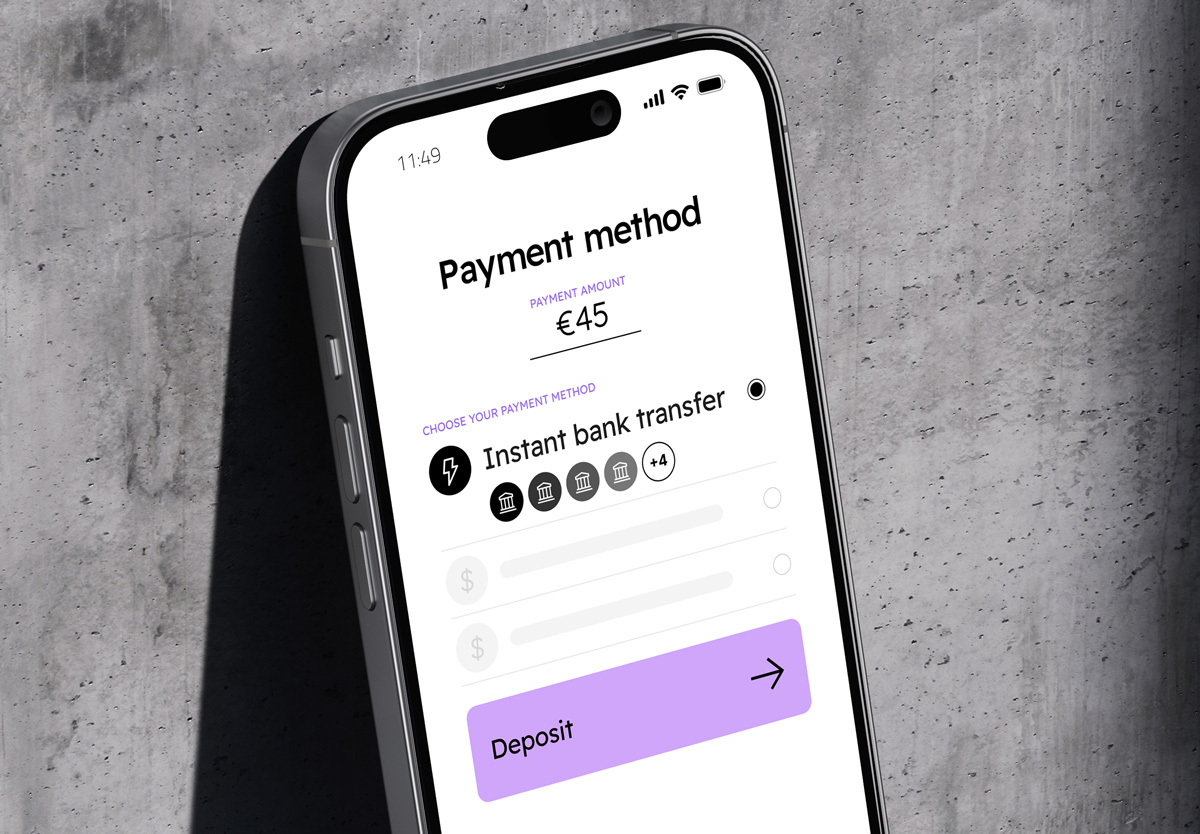

Deposits

Get paid immediately with 98% conversion rate. No cut-off times, no delays and no chargebacks. Just a greatly improved cash flow.

Why Zimpler?

Speed

Instantly register, pay and get paid. Locally and across borders. It’s all lightning-fast.

Safety

Reduce financial crime risks with the right tools, all on an AML-compliant platform.

Simplicity

Get access, remove hurdles and automate flows. All with one easy integration.

Service

Get dedicated support and new solutions, growing your business today & tomorrow.

Not sure what’s

right for you?

No sweat, take our quiz. Your business is unique, with distinct challenges, goals and opportunities. That’s why we’re here to guide you through the payment jungle and find the perfect solutions for you.

Don’t listen to us.

Listen to our customers who are growing their businesses with us today.

FAQ

What is A2A (account-to-account)?

The short version: A2A (account-to-account) is a method for instantly transferring funds from one bank account to another. It’s also known as instant payments or direct bank transfers. For a little more context: A2A is a fundamental part of open banking, a framework that allows secure sharing of your financial data with authorized third parties, such as Zimpler. These transactions happen through specialized networks called payment rails, removing the need for intermediaries or physical things like cards. Zimpler can initiate A2A payments on your behalf using open banking APIs (application programming interfaces), making them one of the safest, quickest and most convenient ways to send and receive payments.

Are you a licensed payment provider?

Yes, we are fully licensed and supervised by Finansinspektionen (the Swedish Financial Supervisory Authority).

How do you work with AML?

Glad you asked! Because to us, AML is so much more than tick-the-box compliance or meeting a legal minimum – it’s a core of our business. We want to be a positive force in everything we do and ensure that our services and partners are only used for legitimate purposes. How? We minimize the risk of anyone using our services for money laundering, terrorist financing or other financial crimes by implementing Europe’s best AML program within fintech.

We have a strong and experienced in-house AML team responsible for our thorough customer onboarding and transaction monitoring processes to ensure that we assess, manage and mitigate potential money laundering and terrorist financing risks following our risk appetite.

We are committed to conducting business with reputable customers and counterparties that uphold the same high ethical standards as us, and equally high standards for combatting financial crime and other illegal activities.