Why choose

Zimpler deposits?

Because you should never have to wait for payments, ever. We know the difference instant and reliable transactions make on both ends. No headaches, just lightning-fast transfers boosting your cash flow.

Instant

Lightning-fast deposits settling in seconds. Let your customers pay straight from their account.

Flexible

One-off, fixed or varying amounts? You’re the boss of how you want to get paid.

Safe

We always run KYC checks and all payments on our platform is monitored for AML compliance.

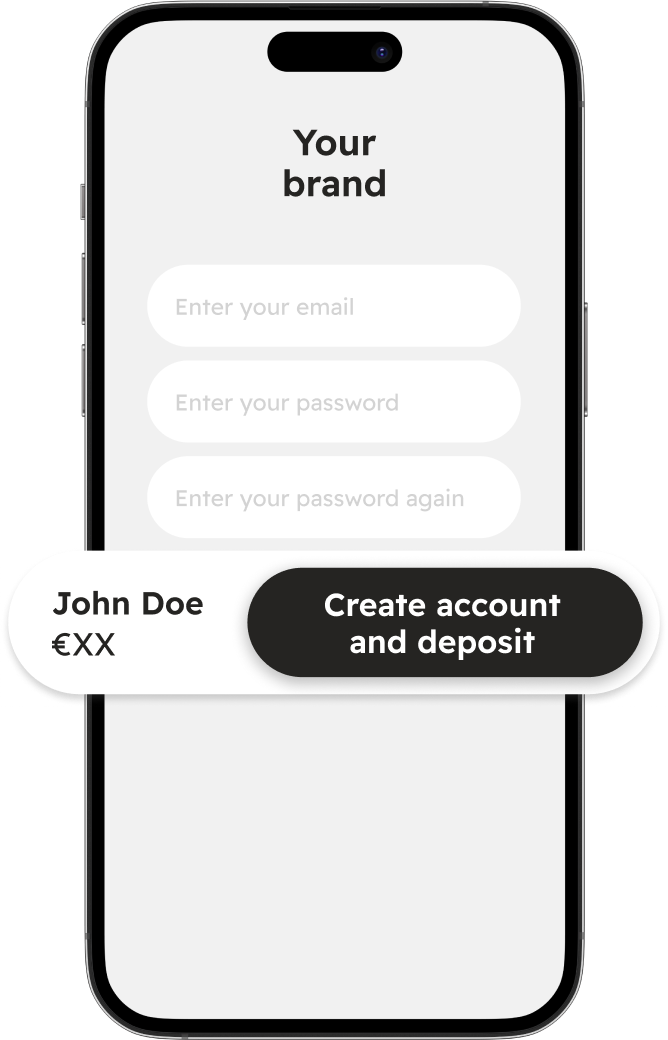

Zimpler Go

A powerful package of Instant Deposits, Instant Payouts and Customer Identification & Data, for maximum results.

- Lightning fast registration

- Instant transfer of funds

- Embedded KYC & AML

High conversion

The speed and ease of the combined registration and deposit process reduces customer drop-offs.

User experience

Our flows are fast and intuitive, and thanks to the closed loop, your customers can get one-click payouts.

Reduced risks

With our embedded KYC checks, we drastically lower the risks of you being exposed to financial crime.

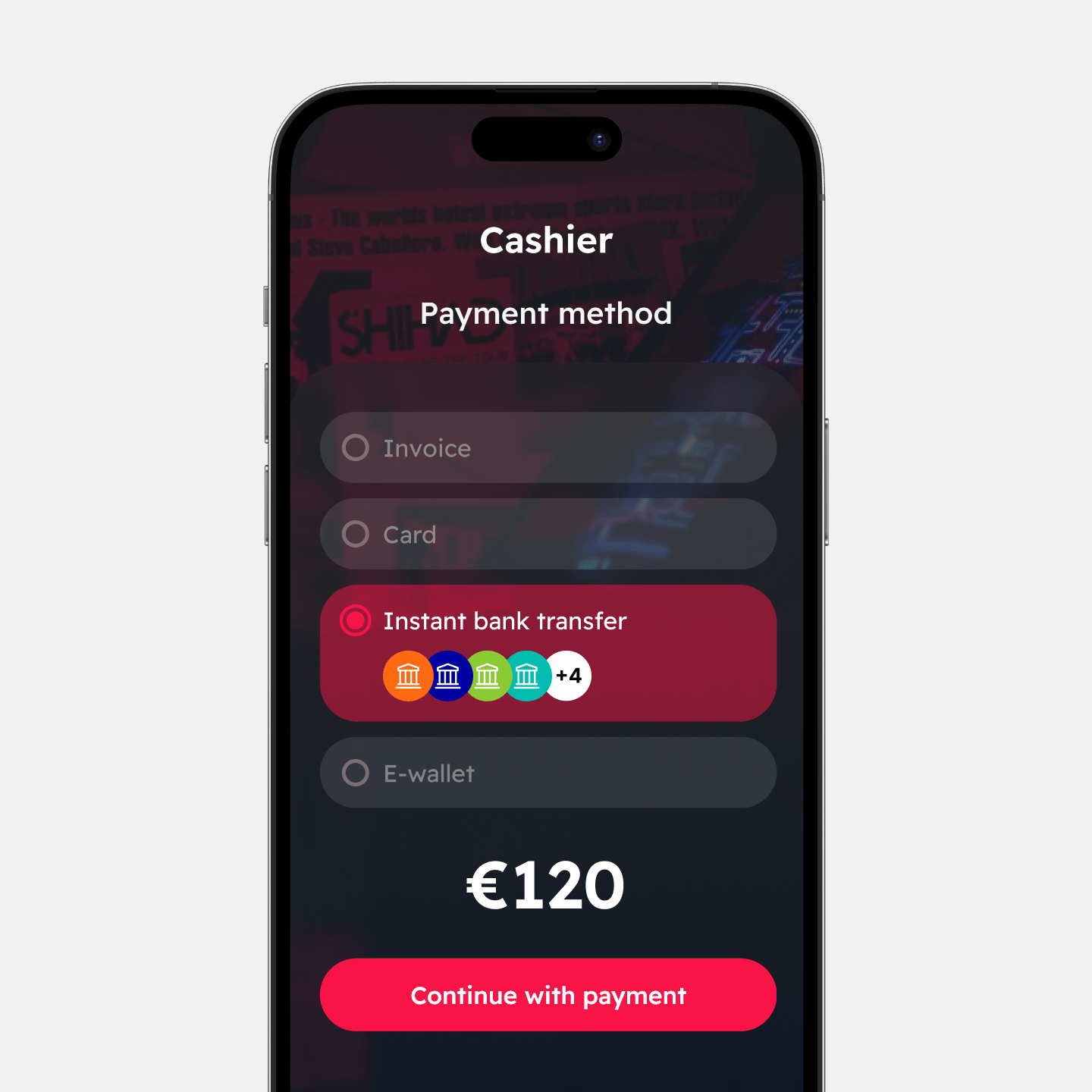

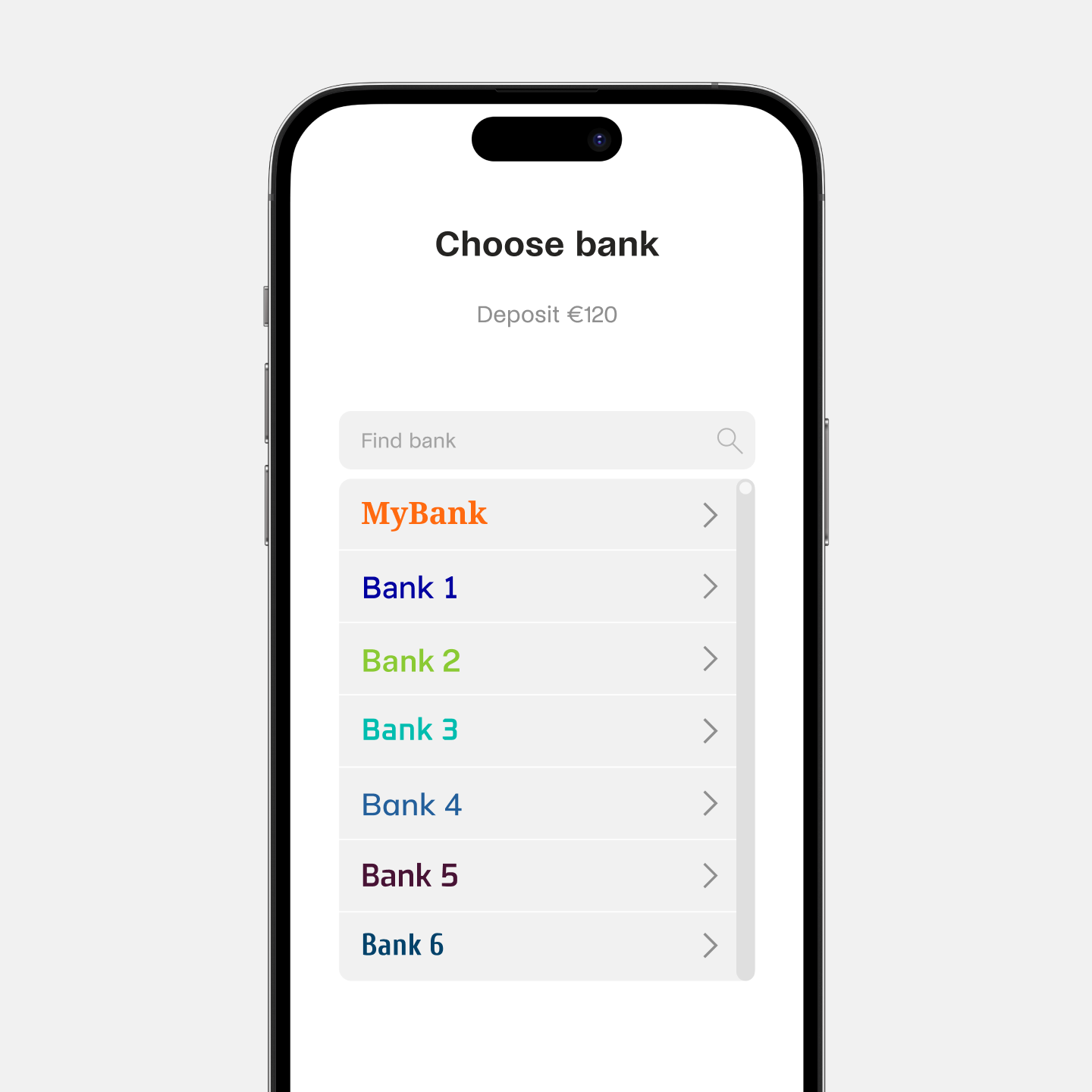

Instant Deposits

Get paid. Now. With this solution, your customers pay you instantly from their bank account, without the need for cards.

- Instant transfer of funds

- Embedded KYC & AML

- High transaction limit.

Boosts cash flow

Supreme user experience and instant access to funds means better conversion and cash flow.

Available 24/7

No waiting time, no delays, no fuss. Instant Deposits are available 24/7, 365 days a year.

Reduced risks

We always run KYC checks and all payments on our platform is monitored for AML compliance.

Don’t listen to us.

Listen to our customers who are growing their businesses with us today.

Add-on capabilities for extra boost.

Once you choose the right core payment solutions for you, you unlock the selection of add-on capabilities. They increase efficiency and safety, while cutting admin and unnecessary costs.

Embedded Flows

Why should your brand disappear just because it’s payment time? With this add-on, you can customize our flows with your own fonts and colors, enhancing your overall customer experience.

- Text: choose font, weight, color & alignment.

- Logotype: your logo in the size you want.

- Icons: add your icons for maximum brand impact.

- Form elements: background, borders, styles & margins.

Your trusted brand

Your customers love your brand and most importantly – they trust it. Let’s leverage that all the way.

Stronger conversion

Skeptical customers might shy away when presented with another interface, ensuring they feel right at home.

Customizable

Colors, sizes, icons and styles. You can do almost anything to make the user interface look uniquely yours.

Seamless experience

Give your customers a flawless experience by having your brand present from start to finish.

FX

Power up your business with our seamless FX service. Optimize currency exchange, save costs, and go global with ease.

- Competitive currency exchange rate.

- Seamless flows.

- Cost-effective.

- Time-saving.

From Europe to Brazil

Convert Euros to Brazilian reais for collecting deposits & initiating payouts, while you can settle funds back in Euros.

Within Europe

Reach Sweden, Finland, Denmark and Estonia. Collect deposits & initiate payouts in Euro, SEK & DKK, and settle in your transaction currency.

Easy top ups

You can easily top up your Zimpler client funds account, which we convert to the local currency in your desired market.

Easy settlement

Your earnings will return to your Zimpler client funds, which we settle in Euro, DKK or SEK, depending on your choice.

Customer Identification & Data

Know who your customers are with this KYC add-on. It drastically reduces financial crime risk without any extra work for you.

- Get important customer information.

- Compliance checks.

- Easy integration.

- Seamless flow.

Reduces risk

Verifying identities lowers the potential for fraud and ensures regulatory compliance.

User friendly

There are no long forms or text fields to fill out. We fetch the info in one seamless flow.

Less admin

There is no need for document verification or manual scrutiny of information.

Easy overview

In your Zimpler back office, you can easily view and download KYC data.

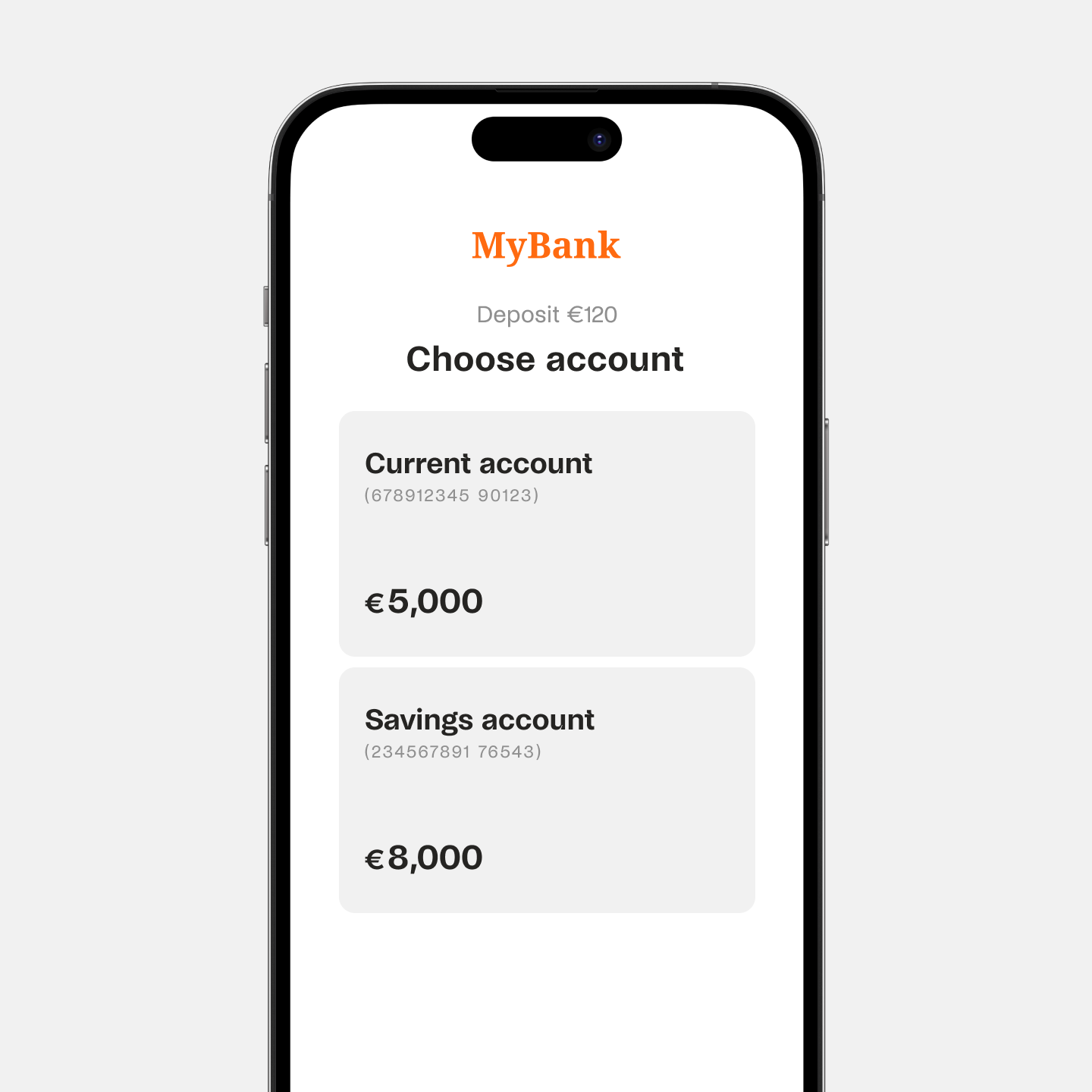

Account Information

Link your customers with the correct bank accounts to initiate instant payments with a single click. It doesn’t get easier than that.

- Automated accuracy.

- Verified by banks.

- All necessary details.

- Easy integration.

No manual errors

It happens to the best of us, but not with this solution. Say goodbye to typos.

A safe option

The account link is always verified with the latest bank authentication method.

User friendly

There are no forms to fill, no finding account numbers, just a seamless flow. Easy.

Less admin

There is no need for manual entry or data storage of any kind. We’ll take care of that.

FAQ

What is A2A (account-to-account)?

The short version: A2A (account-to-account) is a method for instantly transferring funds from one bank account to another. It’s also known as instant payments or direct bank transfers. For a little more context: A2A is a fundamental part of open banking, a framework that allows secure sharing of your financial data with authorized third parties, such as Zimpler. These transactions happen through specialized networks called payment rails, removing the need for intermediaries or physical things like cards. Zimpler can initiate A2A payments on your behalf using open banking APIs (application programming interfaces), making them one of the safest, quickest and most convenient ways to send and receive payments.

Are you a licensed payment provider?

Yes, we are fully licensed and supervised by Finansinspektionen (the Swedish Financial Supervisory Authority).

How do you work with AML?

Glad you asked! Because to us, AML is so much more than tick-the-box compliance or meeting a legal minimum – it’s a core of our business. We want to be a positive force in everything we do and ensure that our services and partners are only used for legitimate purposes. How? We minimize the risk of anyone using our services for money laundering, terrorist financing or other financial crimes by implementing Europe’s best AML program within fintech.

We have a strong and experienced in-house AML team responsible for our thorough customer onboarding and transaction monitoring processes to ensure that we assess, manage and mitigate potential money laundering and terrorist financing risks following our risk appetite.

We are committed to conducting business with reputable customers and counterparties that uphold the same high ethical standards as us, and equally high standards for combatting financial crime and other illegal activities.

Latest from our blog.

It all starts here.

Tell us about yourself, and we’ll get back to you within 24 hours. Let’s find out how we can create value for you and drive growth for your business.