High conversion

The speed and ease of the combined registration and deposit process reduces customer drop-offs.

Unrivaled user experience

Our flows are fast and intuitive, and thanks to the closed loop, your customers can get one-click payouts.

Reduced risks

With our embedded KYC checks, we drastically lower the risks of you being exposed to financial crime.

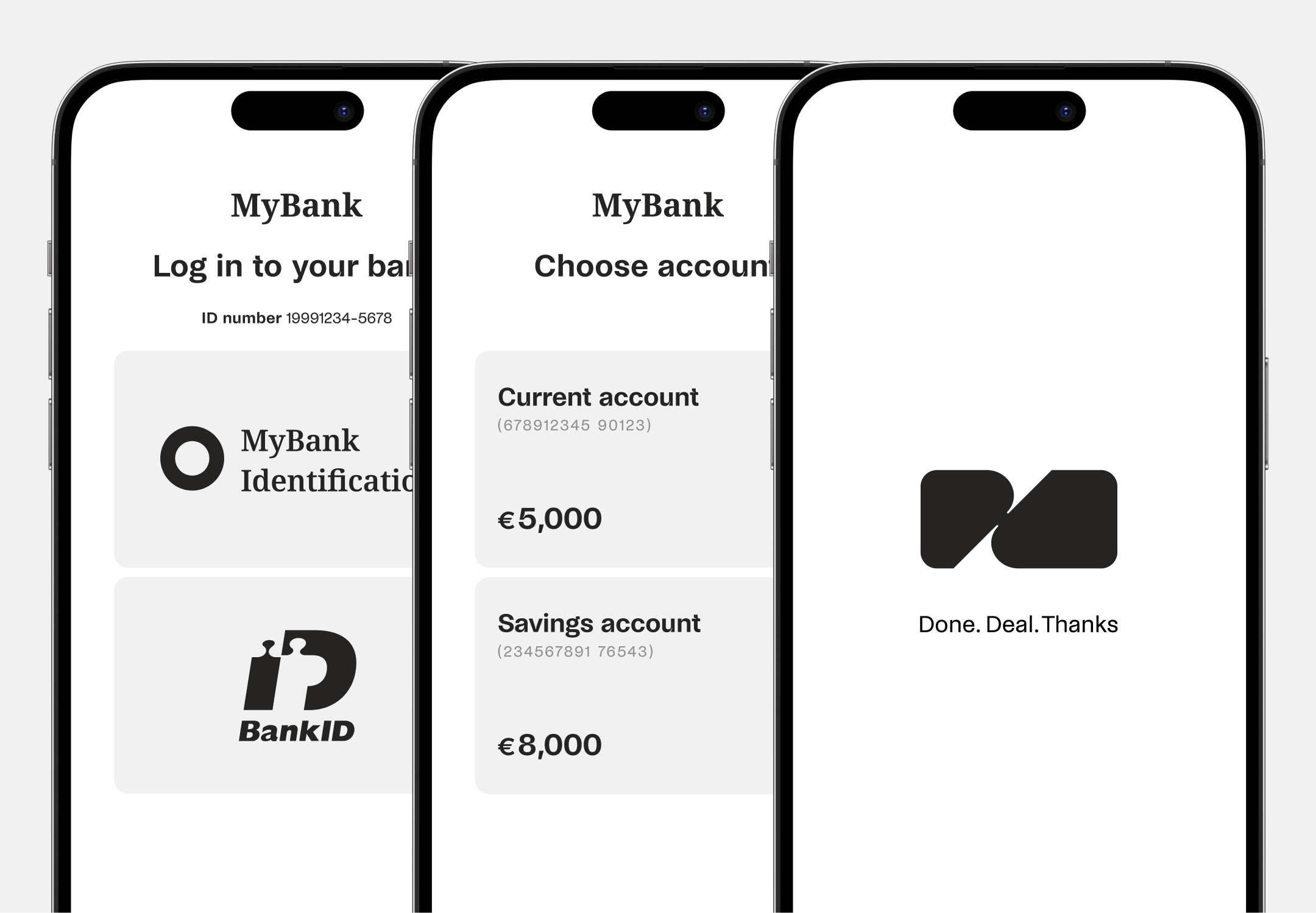

Europe.

Flow for new customers: Registration, log in & deposit.

- Customer selects bank and logs in.

- They choose which bank account to deposit from.

- They verify and hit the ground running

Flow for returning customers: Log in & deposit.

- Customer selects bank and logs in.

- They verify payment.

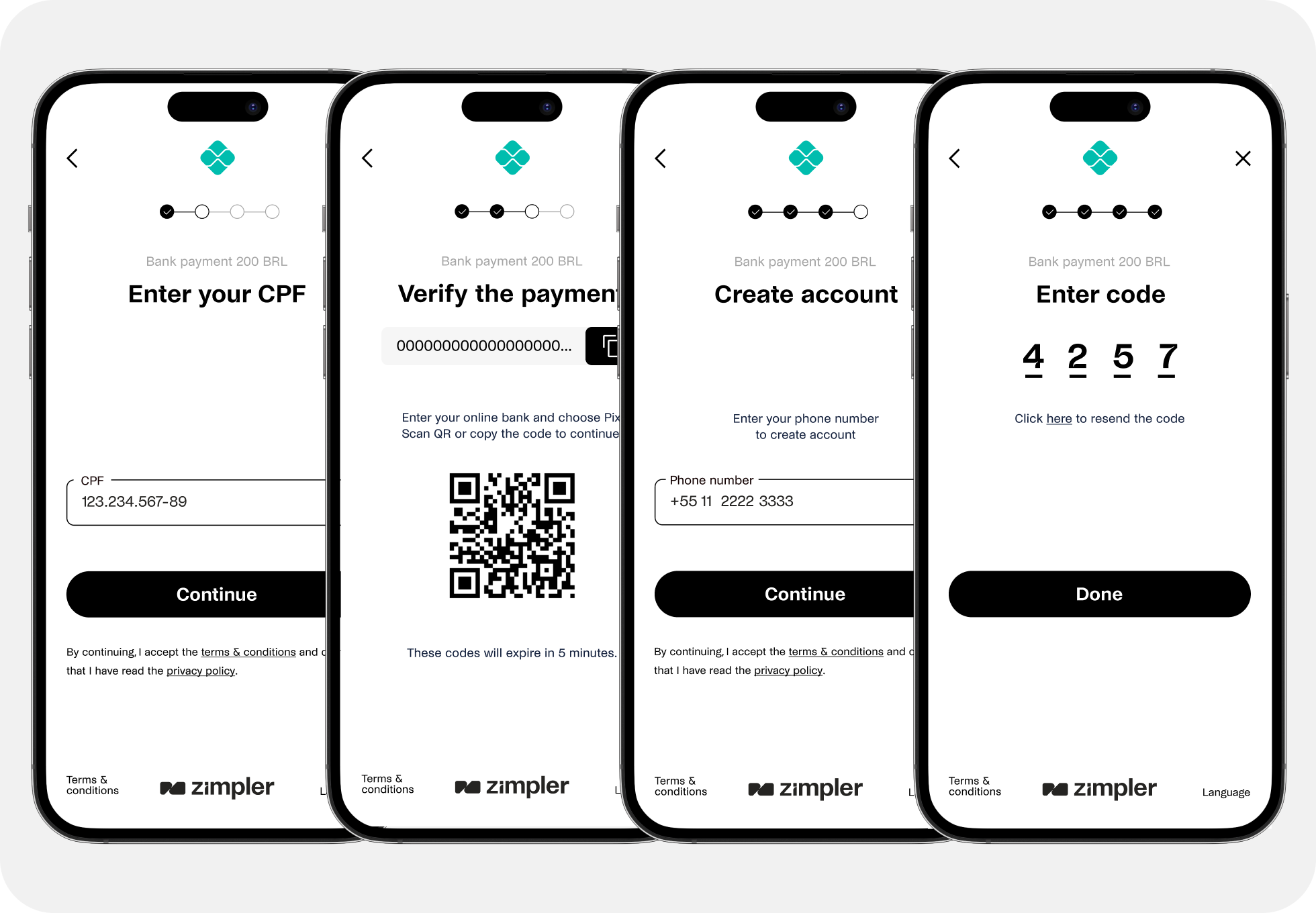

Brazil.

Flow for new customers: Registration, log in & deposit.

- Customer enters CPF

- They verify the payment through PIX

- They verify phone number

The result?

Turbocharged payment and login speeds.

As low as

to login

As low as

to login and pay

Lightning-fast registration

No conversion killers, just a seamless registration flow combining KYC and deposit in a snap.

Embedded KYC & AML

We catch necessary customer information in our flows, running on our AML-compliant platform.

Instant transfer of funds

No delays, no fuss, just instant transfers directly to and from your customers’ bank accounts.

Integrated payment flow

No downloading of apps, creating accounts or remembering details. Just a seamless flow.

Real-time reports

In our Zimpler back office, you can view and download transaction reports updated in real time.

No dependency on cards

No cards means no credit or chargebacks, while drastically reducing risk of financial crime.

Want to know more?

Don’t hesitate to reach out, we’ll happily answer any question you got.

Don’t listen to us.

Listen to our customers who are growing their businesses with us today.

FAQ

What is A2A (account-to-account)?

The short version: A2A (account-to-account) is a method for instantly transferring funds from one bank account to another. It’s also known as instant payments or direct bank transfers. For a little more context: A2A is a fundamental part of open banking, a framework that allows secure sharing of your financial data with authorized third parties, such as Zimpler. These transactions happen through specialized networks called payment rails, removing the need for intermediaries or physical things like cards. Zimpler can initiate A2A payments on your behalf using open banking APIs (application programming interfaces), making them one of the safest, quickest and most convenient ways to send and receive payments.

Are you a licensed payment provider?

Yes, we are fully licensed and supervised by Finansinspektionen (the Swedish Financial Supervisory Authority).

How do you work with AML?

Glad you asked! Because to us, AML is so much more than tick-the-box compliance or meeting a legal minimum – it’s a core of our business. We want to be a positive force in everything we do and ensure that our services and partners are only used for legitimate purposes. How? We minimize the risk of anyone using our services for money laundering, terrorist financing or other financial crimes by implementing Europe’s best AML program within fintech.

We have a strong and experienced in-house AML team responsible for our thorough customer onboarding and transaction monitoring processes to ensure that we assess, manage and mitigate potential money laundering and terrorist financing risks following our risk appetite.

We are committed to conducting business with reputable customers and counterparties that uphold the same high ethical standards as us, and equally high standards for combatting financial crime and other illegal activities.

Instant Deposits

Get paid. Now. With this solution, your customers pay you instantly from their bank account, without the need for cards.

Recurring Deposits

This solution lets you offer a variety of standing deposit plans to suit all needs, all equally seamless for you and your customers.

Latest from our blog.

Read more: New product update delivers an immediate 2% acceptance rate boost.

Read more: New product update delivers an immediate 2% acceptance rate boost.Zimpler launches a payment flow solving in-app browser drop-offs and increasing Acceptance Rates by up to 2% for early adopters.

Read more: Why Brazil’s iGaming boom needs smarter payments

Read more: Why Brazil’s iGaming boom needs smarter paymentsWith Brazil’s iGaming sector projected to hit $5.8B by 2027, seamless, compliant payment solutions like Zimpler are key to success.…

Read more: What drives iGaming growth in the Nordics? Nicolas Lund from Frank & Fred explains.

Read more: What drives iGaming growth in the Nordics? Nicolas Lund from Frank & Fred explains.Discover what drives iGaming growth in the Nordics. Nicolas Lund, COO at Frank & Fred, shares insights on payments, trust…

It all starts here.

Tell us about yourself, and we’ll get back to you within 24 hours. Let’s find out how we can create value for you and drive growth for your business.