Why businesses go with Zimpler.

Many Swish solutions require merchants to establish and manage a direct bank relationship. This often involves bank-led onboarding processes not designed for regulated or high-complexity businesses.

The result is higher costs, longer onboarding times, operational complexity and offboarding risks.

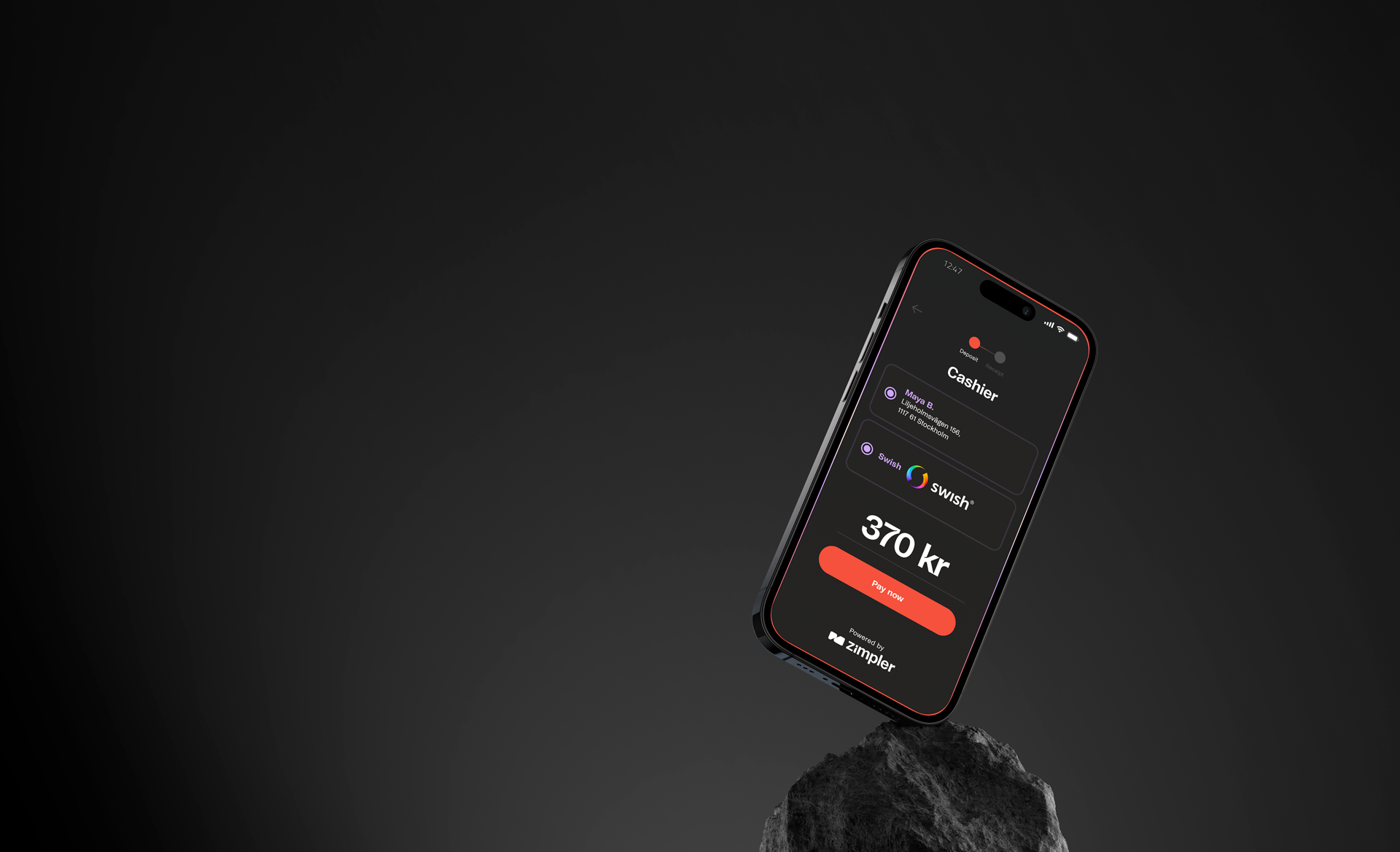

Zimpler simplifies this setup by acting as a single point of integration tailored for your industry. We give businesses access to Swish and Sweden’s payment infrastructure without managing a direct bank relationship in day-to-day operations. You get the benefits of a bank-led setup, without the drawbacks.

What direct access means for your business.

1. Predictable performance

Removing intermediaries results in fewer failure points, higher uptime and consistent performance across every device.

2. Compliance shaped for demanding operations

Compliance models calibrated for regulated businesses reduce friction, false positives and manual reviews.

3. Long term stability

Independence from shifting bank risk appetites and proxy providers means fewer surprises and a setup designed to last.

4. Fewer suppliers, more control

Swish and Pay by Bank in one setup, with unified reporting, consolidated support and fewer contracts to manage.

How Zimpler compares.

| Swish with Zimpler Direct | Third party providers | Banks | |

| Access | Direct core access | Indirect via third party bank(s) or technical partners | Bank core |

| Tailored for complex industries | Yes | Limited | No |

| Compliance and AML frameworks | Tailored | Generic | Restrictive |

| Offboarding risk | Low | Medium to high | High for non core sectors |

| Integration | One | Multiple | Multiple |

Swish: Trusted by millions.

Swish isn’t just popular – it’s embedded in daily life. With 8.6 million users and over 300,000 businesses relying on it, Swish dominates Sweden’s payment landscape. Whether for everyday purchases or high-value transactions, it’s the payment method of choice for Swedish consumers.

Who can benefit?

Any business looking to reach Swedish consumers with a payment method they already know and trust.

Swish with Zimpler is especially valuable for industries like iGaming, trading, and fintech that have faced onboarding challenges in the past. With us, access is now seamless and reliable.

Get started in no time.

1. Apply

Share basic information. We handle commercial details, agreements and KYC.

2. Integrate

Your Zimpler team manages setup, testing and validation.

3. Go live

Swish goes live once everything is verified.

4. Optimize

Continuous monitoring, insights and performance tuning.

See how Ninja Casino leveraged Swish with Zimpler.

Ninja Casino successfully integrated Swish payments through Zimpler, streamlining their transactions and offering customers a seamless, trusted payment experience. By reducing onboarding friction and improving deposit efficiency, they enhanced player satisfaction and saw a conversion rate of up to 99%.

record conversion rate

average acceptance rate

What are you waiting for?

Let’s talk about how Zimpler can power your business with Swish.